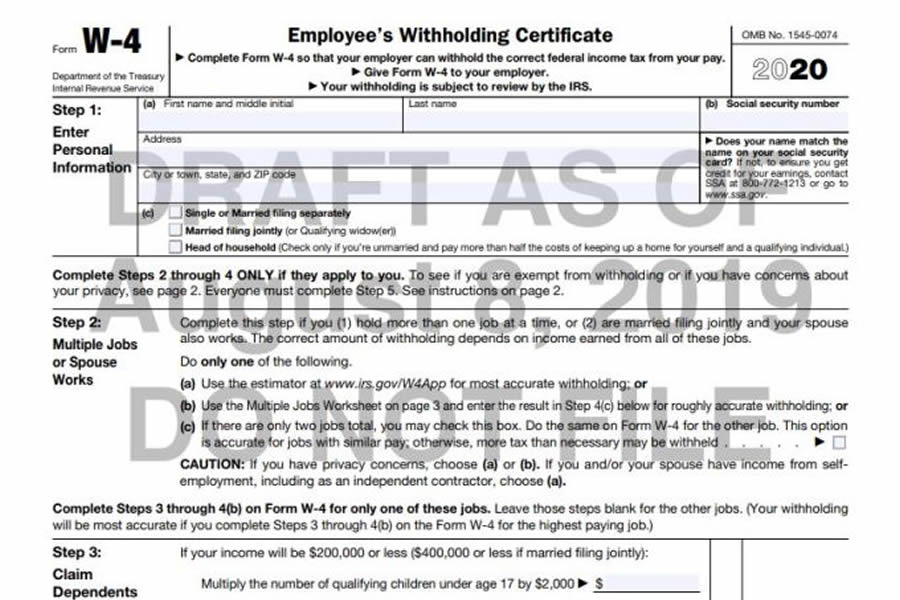

Redesigned W-4 Form

08-13-2019Tax InformationThe Internal Revenue Service released a redesigned Form W-4 for tax year 2020. The redesigned Form W-4 employs a building block approach to replace complex worksheets with more straightforward questions that make it simpler for you to figure a more accurate withholding. The new form uses a more personalized, step-by-step approach.

Employees who have submitted a Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee’s most recently submitted Form W-4.

Impact on IRS Operations during Government Shutdown

12-28-2018Tax InformationDue to the current lapse in appropriations, IRS operations are limited. However, the underlying tax law remains in effect, and all taxpayers should continue to meet their tax obligations as normal.

- Individuals and businesses should keep filing their tax returns and making deposits with the IRS, as they are required to do so by law.

- The IRS will accept and process all tax returns with payments.

- Payments accompanying paper tax returns will still be accepted as the IRS receives them.

- Tax refunds will not be issued until normal government operations resume. READ MORE

IRS Proposes Changes to Charitable Contribution Rules related to State Tax Credits

08-27-2018Tax InformationThe IRS proposed legislation on Thursday, August 23, 2018 that would possibly eliminate your ability to use State Tax credits as an Itemized Deduction on your Federal income tax return. If you believe this legislation will become law, here are some quick considerations for you to make by Monday, August 27, 2018. (Yes, you only got 4 days to act)

In Arizona, this proposed legislation would impact donations for state tax credits to:

- Qualified Charitable Organizations (formerly Working Poor)

- Public Schools Activity Fees

- Student Tuition Organizations

- Military Family Relief Fund

- Foster Care

Other states may have programs like Arizona to allow such credits.

READ MORE

2018 Form 1040 to be shorter but with more schedules

06-30-2018Tax InformationThe IRS is still working on a draft version of the 2018 Form 1040, U.S. Individual Income Tax Return. The 1040 will be two half-pages in length, but moves many items formerly on the 1040 to new schedules.

READ MORE

President Trump claims tax cuts will benefit the Middle Class Americans

09-28-2017Tax InformationIs President Donald Trump’s statement earlier this month that “the rich will not be gaining at all with this (proposed tax) plan” true? Will the middle class benefit?

Background

President Trump is looking to overhaul the tax code. He made remarks prior to a September 13 meeting with members from both parties of Congress. The president said he wanted to cut the corporate tax rate from 35 percent to 15 percent and lower individual income taxes.

READ MORE

IRS complies with President Trump’s Executive Order -- will not reject tax returns without health care disclosure

02-20-2017Tax InformationAfter President Donald Trump issued an Executive Order, the IRS announced that it will not reject tax returns just because a taxpayer has not indicated on the return whether the taxpayer had health insurance, was exempt, or made a shared-responsibility payment under Sec. 5000A of the Patient Protection and Affordable Care Act (PPACA).

- The PPACA requires taxpayers who do not maintain minimum essential health coverage for each month of the year and who do not qualify for an exemption to pay a shared-responsibility payment with the filing of their Form 1040, U.S. Individual Income Tax Return.

- Although the health insurance information requirement has been in effect for a few years, the IRS accepted returns that did not contain the information READ MORE

Myths on Trust Taxation

02-11-2017Tax InformationI periodically get inquiries from individuals who think they can avoid income taxes because they have a trust. Trusts are often very good tools to protect your assets; but not always a good tool for simple tax planning strategies. Trusts generally have much lower deductions, compressed marginal tax rates, and a much lower threshold for the net investment income tax. Thus, a trust may incur higher income taxes than an individual may pay.

READ MORE

Some Tax Forms Arizona Department of Revenue are Incorrect

01-31-2017Tax InformationThe Arizona Department of Revenue announced on January 30, 2017 that it sent out some incorrect 1099-G forms for 2015 taxpayers that received refunds.

The erroneous forms included information from the 2014 tax year, and did not include the correct information from the 2015 tax year.

You can still file your 2016 income tax return – Please use your actual 2015 tax return if your 1099-G document is different.

Proposed Revisions to Tuition Tax Credits and Deductions

08-03-2016Tax InformationThe Internal Revenue Service has proposed revisions to tuition tax credits and deductions for individual tax payers. The changes are meant to be in alignment with the Protecting Americans from Tax Hikes (PATH).

Key things to know:

- No deduction or credit will be allowed unless there is a 1098-T, Tuition Statement, received from the eligible educational institution.

- An exception will be made for items not included on the form (e.g. required course materials that qualify for the American Opportunity Tax Credit)

- Form 0198-T should be received by January 31 of the following year

- Reporting will be more specific for qualified tuition and related expenses paid in one year that relate to the academic period beginning in the first three months of the next calendar year. The prepaid amount would be explicitly stated READ MORE

Maximize Your HSA in 2016

02-16-2016Tax InformationWith individual income tax season under way, I am seeing a number of clients with a high-deductible health insurance plan and a Health Savings Account (HSA). Here are some ways to make the most of your money this year.

In 2016, those with individual high-deductible plans can deposit $3,350 into an HSA, while those with a family plan can contribute a maximum of $6,750. In either case, an extra $1,000 catch-up contribution is allowed for those age 55 or older.

- Open and fund your HSA today. High-deductible health plans can require policyholders to pay thousands out of pocket before insurance coverage kicks in. To soften the blow, the federal government allows those with qualified plans to open HSAs and pay their out-of-pocket expenses with tax-free money. However, the tax savings only applies to expenses paid after the HSA was opened. You don’t need to fully fund it immediately -- or ever. Pay into it what you can.

- Your HSA can be an investment tool. Some HSA accounts work as simple savings accounts and offer a minimal interest. Others let you invest money in mutual funds, just as you would in a 401(k) or IRA.

IRS E-file system temporarily shut down

02-04-2016Tax InformationThe Internal Revenue Service reported it suffered a "hardware failure" on Wednesday afternoon, which left many of its tax processing systems unavailable Wednesday night, the agency announced in a statement.

The agency stopped accepting electronically filed tax returns because of the problem. The outage could affect refunds, but the agency said it doesn't anticipate "major disruptions."

The IRS is still assessing the scope of the outage and indicates nine out of 10 taxpayers will receive their refunds within 21 days. The IRS.gov website remains available, but "Where's My Refund" and other services are not working.

READ MORE